Download Detroit's Roadmap to Recovery

10 YEARS OF BUILDING GENERATIONAL WEALTH IN DETROIT

Scroll down to see key dates and developments.

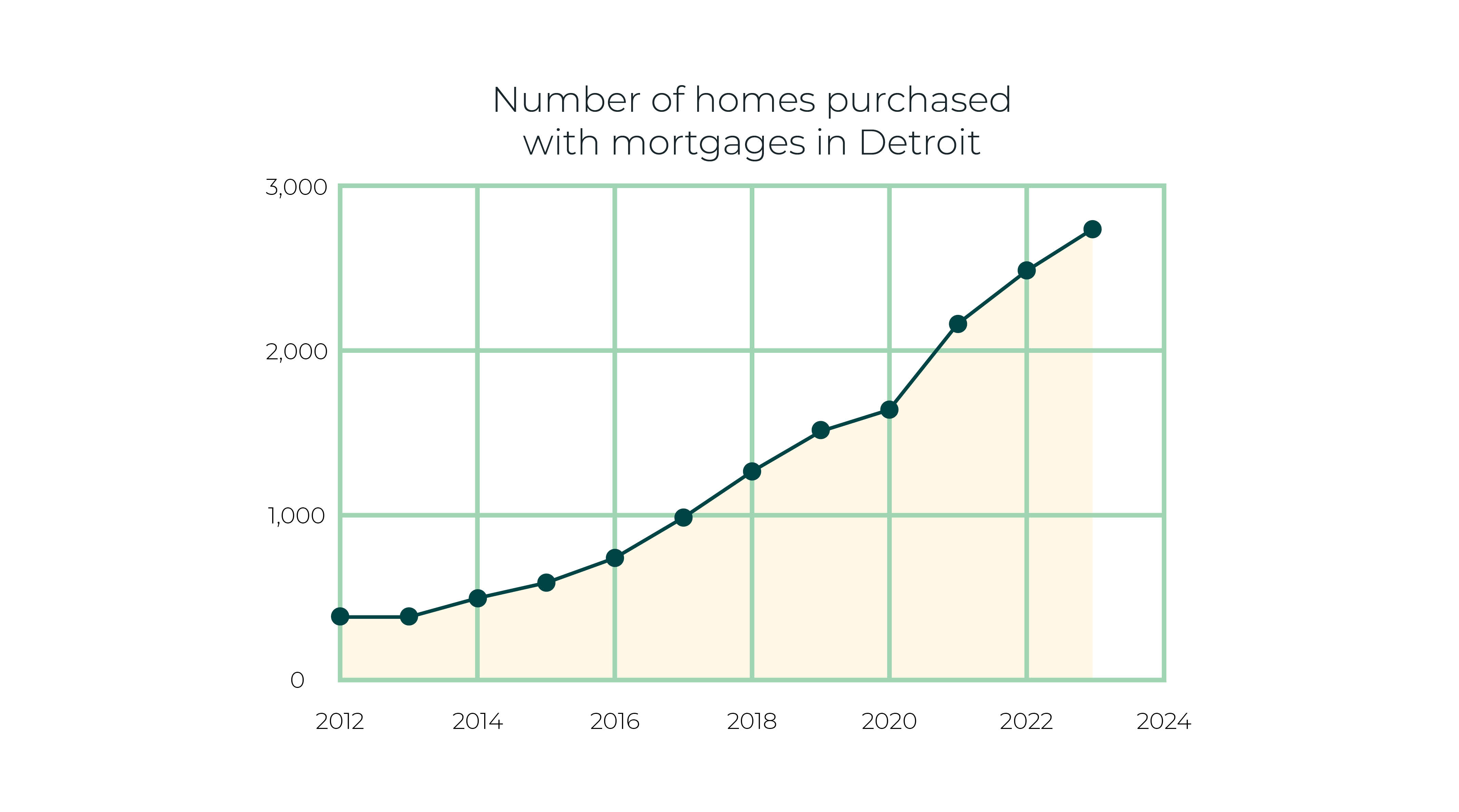

- 2013Housing values plummet 82% during the housing crisis with less than 375 mortgages a year grantedAfter historic write-in win, Mike Duggan is elected Mayor of DetroitDetroit files for bankruptcy

- 2014Detroit Land Bank Authority (DLBA) expands to include consolidated properties owned by various public entitiesNuisance Abatement Program allows DLBA to take ownership of vacant, blighted or dangerous properties not in complianceReplacement begins on 65,000 LED streetlightsDLBA Compliance Team assists homebuyers in bringing or keeping their properties up to code, many of whom are first-time buyersDLBA sells first side lot for $100

- 2015DLBA Rehabbed & Ready Program bridges the appraisal gap between the home's market value and the cost of repairs through cooperation with community partnersDetroit's 0% Interest Home Repair Program offers residents 10-year loans of $5,000 to $25,00050% discount on DLBA homes for city workers and educators

- 2016DLBA Own It Now (OIN) Program sells vacant homes as-is to blind bidders, starting at $1,000DLBA Buy Back Program launches, providing a pathway to homeownership for those who stayedDetroit Home Mortgage Program bridges the appraisal gap and helps to fund renovations with both a home and a secondary loan

- 20196,000+ dilapidated homes are demolished since 2014

- 2020Alley Clean Up Program reduces blight and cleans up illegal dumpingVoters approve Proposal N to reduce blight by funding home demolition and stabilization efforts

- 2021DLBA Neighborhood Lot Sales program lets residents buy up to two lots within 500 feet of their home$4M Delray Home Improvement Program helps eligible Delray neighborhood residents make home repairs

- 2022Renew Detroit Essential Home Repair Fund begins replacing roofs for eligible low-income, senior and disabled homeownersNeighborhood Beautification Program gives grants of $500 to $15,000 to 34 Detroit-based block clubs, neighborhood associations, nonprofits and faith-based organizations for public space improvements in their communities$8.1 billion in property value for Detroit's owner-occupied homes

- 2023Down Payment Assistance Program grants qualified first-time homebuyers up to $25,000 for a down payment or other home purchase-related expensesDetroit Duplex Repair Program allows qualified landlords to apply for grants up to $15,000 per unit for renovations and a rental Certificate of ComplianceThe percentage of owner-occupied homes rises to 54%, with 2,765 mortgages

- 2024Second round of Down Payment Assistance launches, with another $5 million from the American Rescue Plan Act (ARPA) and $2 million from other partners6,765 homes are demolished and 2,416 stabilized for resale by the DLBA

- 2025Detroit named the fastest home-value appreciating city in the United StatesDLBA sells 19,583 homes to Detroiters since its inception and is on track to sell the last home in its inventory by the end of 2025

How Detroit created $3.9 billion in generational wealth

The housing crisis, from 2006 to 2008, devastated the country and Detroit was not immune. Between 2005 and 2015, nearly half of Detroit’s homeowners sank underwater on their mortgages, resulting in 120,000 foreclosures and, more importantly, the depletion of generational wealth for Black residents, in particular.

Housing values plummeted 82% during the housing crisis, significantly reducing Black generational wealth. The City of Detroit's goal has always been to place homes back into the hands of Detroiters while raising housing values.

Mayor Mike Duggan understood that the essence of generational wealth rested in the value of the family home. In partnership with Detroit City Council and with funds from the American Rescue Plan Act (ARPA), the City of Detroit created multiple programs for Detroiters to increase home values and stabilize Detroit’s neighborhoods. Learn how through the Housing and Revitalization Department.

What is generational wealth? It’s wealth that passes from one generation to the next, usually from parents to children, be it real estate—a family business, a family home, other properties—or cash, stocks or other investments. The children can then build this into more generational wealth which they can, in turn, pass on to their children.

Since 2012, renters in Detroit have usually outnumbered owners. The percentage of Black homeowners dropped even lower, affecting Black generational wealth. But, in 2023, the percentage of owner-occupied homes rose to 54% turning Detroit back into a majority homeowning city.

This is the story of how Detroit nearly doubled property wealth from $4.2 billion in 2014 to $8.1 billion in 2022.

The 2014 Property Value Starting Line

Mortgages and the Median Detroit Home Value

In 2014, Detroit's landscape was populated with over 40,000 vacant houses and over 100,000 neighborhood vacant lots, nearly the combined size of 8,000 football fields. Detroit's median home value was $14,000, while the national median home value was $275,000.

This is how Detroit grew from less than 375 mortgages a year in 2009 to 2,765, contributing to Black wealth growth from $3.4 billion in 2014 to $6.2 billion in 2022, showing a $2.8 billion appreciation—an 80% increase.

Detroit's Home Mortgage Incentive Leads to Homeownership Pop!

Many Detroiters wanted to purchase homes in 2014 and had good credit scores and stable incomes, but there were challenges. Most banks were reluctant to issue mortgage loans because of low home appraisals and a lack of comparable nearby homes for comparison. Home improvement loans large enough to renovate these homes were also scarce. The result was that 80% of home sales in Detroit in 2014 were cash.

Mayor Duggan solved this problem by partnering with a diverse group of organizations including the Obama Administration's Detroit Federal Working Group, the Clinton Global Initiative, local banks and credit unions, foundations and nonprofits. Funded by Community Reinvestment Fund, USA (CRF), the partnership created Detroit Home Mortgage.

Anthony Ford, a man with an ample income and a respectable credit score, was turned down five times for a traditional bank loan. Through the Detroit Home Mortgage program, he was able to purchase his home, saying, "I'm excited about [what] this does for me and the city."

The goal of Detroit Home Mortgage was to increase the number of mortgages by bridging the appraisal gap and helping fund renovations until traditional mortgages became more obtainable. It worked by combining a second mortgage with a conventional first mortgage. This resulted in at least 232 mortgages.

First-Time Homebuyers Get Down Payment Assistance

Detroit committed itself to turning renters into homeowners and to increasing the value of each home purchased. In 2023, Detroit inaugurated its Down Payment Assistance Program (DPA) to help qualified first-time homebuyers. Grants up to $25,000 were available per Detroit resident.

To qualify, they could not currently own a home and must earn less than $41,000 annually for a single person.

DETROIT'S DOWN PAYMENT ASSISTANCE PROGRAM IS SO SUCCESSFUL THAT IT BECAME THE NATIONAL MODEL

The program is intended for Detroit residents like Satin Adams. She lived in subsidized housing with her six children but dreamed of a house with a yard for the kids to run and play. The DPA allowed her to purchase a single-family home in Morningside. "My mom never bought a home. My siblings never bought a home, so this is great for me," Adams, 32, said.

The first round of the program was funded with $12 million from ARPA funds and created 434 homeowners. The second round launched in 2024 with another $5 million from ARPA funding and $2 million from other partners.

With the number of mortgages starting to increase, the City of Detroit turned toward managing the large housing and vacant lot inventory with the oversight of the Detroit Land Bank Authority (DLBA).

Detroit Land Bank Innovates a Pathway to Homeownership

The abandoned housing and vacant lot oversight was split between three entities: the City of Detroit, the Wayne County Treasurer and the Michigan Land Bank Fast Track Authority. Three bureaucratic organizations created confusion and complications to purchasing city-held properties. In 2014, Mayor Duggan consolidated the entities into the Detroit Land Bank Authority (DLBA).

“We had a state land bank, we had a city land bank, and we had a county land bank,” Mayor Duggan said in 2014. “Every one of them has good ideas and every one of them is going in a different direction.”

Although the DLBA is a public agency with a budget approved by the City Council, its five-member board is appointed—four by the Mayor of Detroit, one by the Michigan State Housing Development Authority—not elected, and it has a large degree of independence. The Detroit Land Bank was tasked with creating a solution for every property. Here is how the DLBA found success.

To tame the nation's largest land bank inventory, the DLBA created an online catalog of every property and vacant lot in the city. Each of the 40,000 vacant homes and nearly 100,000 vacant lots were listed on the DLBA website complete with property details and pictures, allowing buyers an efficient way to view and purchase homes.

Housing Auction & Own It Now Program

Currently, three homes are auctioned every weekday, during an 8-hour window (9 a.m.-5 p.m.). The DLBA has closed on 16,777 through its Auction and Own It Now initiatives and 1,268 in its Buy Back program as of October 2024. That's an average 188 houses sold every month for eight years.

The Own It Now (OIN) program offers vacant homes for sale with a minimum offer price of $1,000. Homes are sold on an as-is basis and have not been cleaned out or secured. Buyers are required to rehab houses after purchase and ensure that they are occupied. OIN has sold over 10,000 homes since 2016.

These sales increased the median home sale values of Detroit's neighborhoods—such as Chadsey Condon, Jefferson and Mack—by 500%. These increases added $3.9 billion to the city's overall housing wealth, a 94% increase.

Buy Back Program

Deed ownership is a complex game. Through no fault of their own, many families were in danger of foreclosures due to tangled titles and other issues that mar clear titles through informal transfers. Mayor Duggan knew this generational wealth must be returned to the family and so, with the DLBA, created the Buy Back Program to get home titles back into the hands of the families.

“Working with the Land Bank was a great experience,” said Emoni Davey at a deed ceremony. “I’ve always dreamed of being a homeowner and Buy Back made it possible. This process inspired me to enroll in trade school to learn how to do home repairs and now I’m building the future I see for my family.”

The process takes a full year with achievable benchmarks along the way, including financial literacy resources through program partners Citizens Bank and 5/3 Bank, as well as local nonprofits who provide homeownership workshops and counseling designed to support buyer success. As of August 2024, nearly 1,300 participants have successfully earned their deeds back, allowing them to build generational wealth through homeownership.

Rehabbed & Ready

The Rehabbed & Ready program provides a unique solution to houses that require renovation in order to be livable. The renovations are done by city contractors before the sale of the house, and it bridges the appraisal gap between the home's market value and the cost of repairs through a partnership between the City of Detroit ($2.5 million), the Rocket Community Fund ($7.5 million) and Quicken Loans ($5 million).

At least 200 homes have been targeted for renovation with at least 99 already completed and sold as of November 2024. The Home Depot and local contractors make the renovations.

The Rehabbed & Ready houses were meant to stabilize neighborhoods, which directly affects housing wealth, by investing in quality improvements—energy efficient HVAC systems, new windows, sewer and water lines—and completing full environmental abatement before the properties are listed on traditional selling platforms.

Each move-in ready home is guaranteed a one-year supplemental home warranty, a $1,500 Home Depot gift card and three months of paid alarm service.

50% Discount for City Workers & Educators

To facilitate Detroit city workers’ ability to own a home, in 2015, the DLBA began its City Employee Discount Program, allowing them—including full-time educators and support staff within the City of Detroit—access to the DLBA inventory at half off of the listed price or auction price. City workers, teachers and skilled trade employees accounted for 973 mortgages acquired under this discount program.

This 50% discount comes with the caveat that they must own the property for three years. If the owners sell before the three-year mark, they must pay the DLBA a portion of their profits: 75% in the first year, 50% in the second and 25% in the third.

Buyers must also be in good standing with the City and Wayne County (no delinquent taxes, no blight or code violations) and have the home rehabilitated and occupied within six months.

A similar program was added for members in good standing of trade union locals through the City of Detroit's Skilled Trade Employment Program (STEP).

By February 2025, the DLBA sold 18,000 homes to Detroiters. It is on track to sell the last home in its inventory by the end of 2024. The DLBA adds value by increasing homeownership, eliminating blight and making neighborhoods safer and more attractive.

Compliance Requirements

Just under 11,000 of the DLBA's structures between 2014 and 2022 went to Detroiters , many of whom were first-time homebuyers. The DLBA set up a compliance program to assist those homebuyers in bringing or keeping their properties up to code.

The program successfully saw 9,735 owners in full compliance with the DLBA as of October 2024. The team works with the new homeowners, tracking their progress and keeping them on schedule.

Step 1 - The Compliance Team requires each owner to sign a Nuisance Abatement Program Rehab Agreement which dictates that the property owner must upload improvement pictures every 45 days directly to their designated Compliance Representative.

Step 2 - Own It Now (the most popular program) owners must get a Preliminary Inspection Report (PIR) from Detroit's Buildings, Safety Engineering and Environmental Department, as well as upload photos of the subsequent inspection report. Photos of the property are also required to be uploaded.

Step 3 - Owners must keep the exterior of their homes in good condition with a debris-free yard. They are required to maintain an installed and functional furnace and hot water heater. The property's bathrooms and kitchen must be functional.

Step 4 - All utilities must be maintained and copies of the paid bills sent to the team on the 45-day check-ins.

Step 5 - The Compliance Representative conducts a Compliance Achieved walk-through before the owners receive a Release of Interest (ROI) from the DLBA, which completely frees the deed. If homes are not in compliance, the would-be buyers must yield their interest on the deed back to the DLBA.

Detroit Cleared Blight Bringing in Opportunity

In 2014, over 40,000 homes required immediate demolition. Holding to his mantra that “every neighborhood has a future,” Mayor Duggan resolved to tear down the blighted homes to stabilize Detroit's neighborhoods. By the end of his first year in office, the city demolished over 4,000 homes.

Five years later, over 6,000 blighted homes were removed, allowing Detroit neighborhoods to grow and repopulate. Additionally, 15,000 homes were saved from the wrecking ball for future first-time homebuyers.

For years, an auto shop sat vacant on Fenkell Avenue. The city's Blight Removal team remediated the property by cleaning out the trash and painting the building. These efforts caught Rob Sim’s attention. He purchased the building with the intent of transforming it into a youth center for his nonprofit, The Movement Stop the Violence Detroit. Simm's vision is precisely what the City of Detroit hoped for through its blight removal programs.

For the individual homeowner, each of the over 29,000 demolitions. increased the value of neighboring properties (those within 500 feet) by 4.2%. The city has seen a nearly $209 million increase in home values as a direct result of blight removal.

But still more houses required removal. Mayor Duggan turned to Detroit residents in 2020 to help fund the demolition efforts, leading to the voter-supported bond initiative called Proposal N.

Proposal N

In 2020, voters agreed to fund 16,000 further blight-reducing demolitions and vacant home stabilizations (not covered or allowed by previous programs) by approving Proposal N, a $250 million bond initiative. By July 2025, more than 8,000 homes had been demolished. By April 2025, 4,700 homes were stabilized for resale.

Safety in the City

Ten years ago, about 40% of the city’s streetlights were broken. The city was dark and felt dangerous. Detroit solved this problem by installing 65,000 LED streetlights.

“We have a very conservative strategy, but we’re putting up 1,000 streetlights a week,” Mayor Duggan said in 2015, adding, “We’ve put up 35,000 in the last year and people are no longer living in the dark.”

The city should see tangible benefits from the $185 million investment, as have other cities. In 2022, nighttime accidents did decrease to their lowest levels since 2019.

The City of Detroit continued to focus on safety through several initiatives including Project Greenlight and increasing police officers’ salaries. As a result, homicides are down. By 2023, the homicide rate was 39.4 per 100,000 and the total number (252) hasn’t been lower since 1966. Overall violent crime in 2023 was down 1% from the previous year.

How Detroit Used Side Lots to Increase Home-Value Wealth

Maintaining vacant lots is an expensive enterprise. The City of Detroit pays, on average, $13.44 to mow each vacant lot. The average vacant lot is 3,200 square feet.

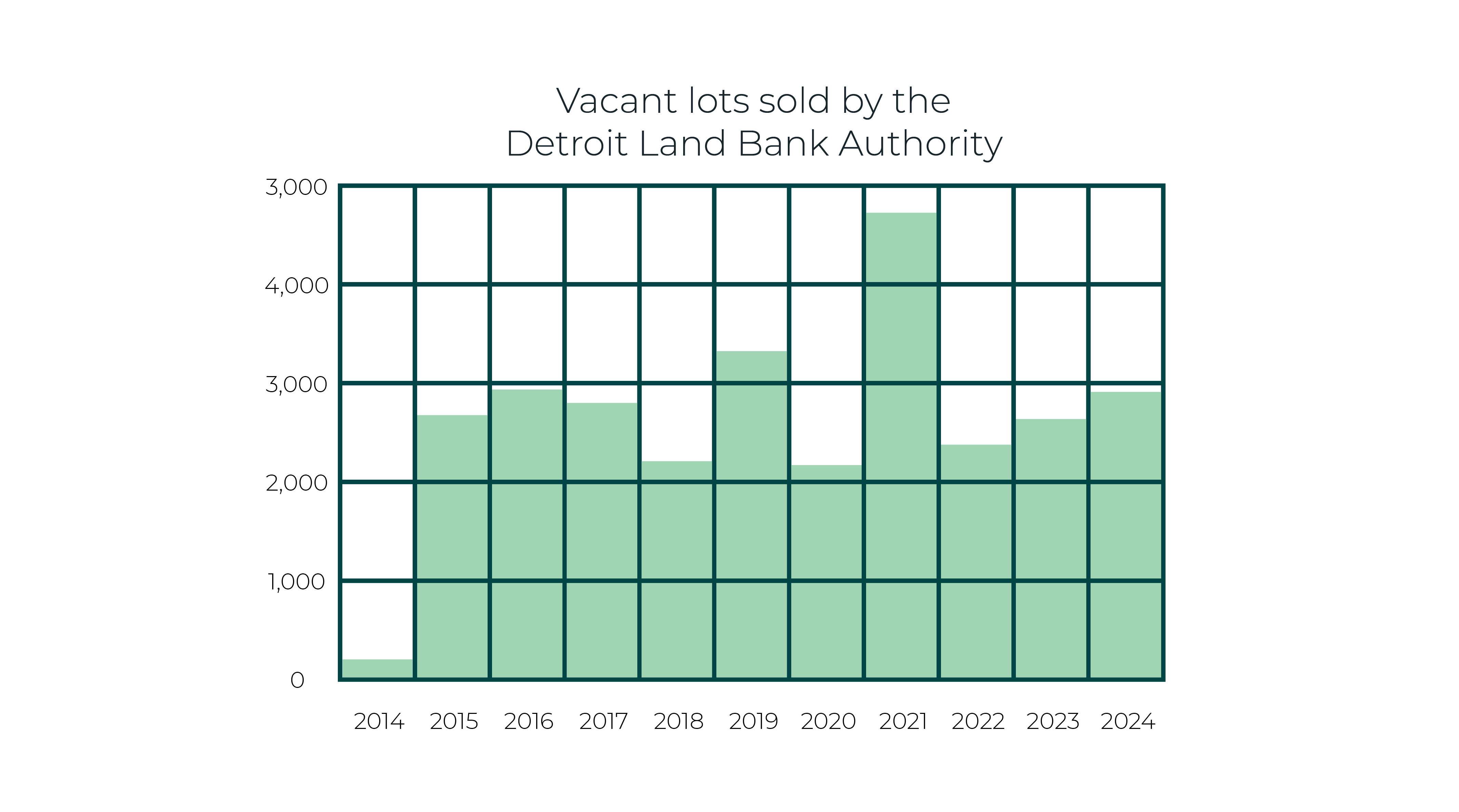

In 2015, Detroit had a staggering 54,099 vacant lots, most of which were not mowed and full of debris. These lots made up about 68% of the DLBA's inventory. It was costing the city $6,720,000 to mow these lots each year. The DLBA needed creative solutions to match owners to the lots.

Additionally, if the DLBA owns the lot, the community is robbed of inventive opportunities to beautify and serve their own neighborhoods. This sparked the Side Lots Program.

To put the land to good use and reduce the financial burden, the city started selling these lots to Detroiters.

There were rules, of course. The empty lot had to be adjacent to the buyer's occupied property on the left side, right side, rear or diagonally behind (even across an alley, but not across the street). The program became the DLBA's most popular.

The Side Lots initiative was so successful that the DLBA sprouted several variations to their program. In 2020, it created the Neighborhood Lots program that allowed individuals to purchase vacant lots within 500 feet of their property for $250. By 2024, the City of Detroit sold 28,283 side lots to its residents.

It then turned its attention to oversized lots, allowing homeowners to purchase lots from 7,501-15,000 square feet with no accessory structure like a garage, gazebo or carport for $200.

The DLBA added oversized lots with accessory structures to its growing menu. It permitted homeowners to purchase lots for residential, recreational or agricultural purposes for $250.

By 2023, the DLBA sold nearly 25,000 vacant lots. Because of the program's popularity, Mayor Duggan has found a way to harness the vacant lot sales to increase home values, building generational wealth. In 2024, the City of Detroit began offering tantalizing incentives to local small-scale developers who buy the DLBA lots through the Infill Lots program.

What the Side Lots Program Did for the City

The Side Lots Program produced positive results by returning these lots to the tax rolls, decreasing blight and clearing up titles to numerous parcels held in legal limbo for years.

The communities soon became involved in collectively purchasing side lots to increase their home values through the DLBA's Create-a-Project program which permits community groups—such as book, garden and block clubs, as well as any neighborhood group registered as an LLC or 501C3—to purchase a vacant lot within their neighborhood's footprint for $250. So far, this program has approved 150 projects.

By 2022, the Neighborhood Beautification Program was in full bloom. This city-led campaign offered organized neighborhood groups grants ranging from $500 to $15,000 to establish gardens, make public space improvements and conduct cleanup activities.

Each LLC or 501C3 group must be city-registered and present their partnership letter to apply. The funds can be applied to construction or maintenance of collaborative neighborhood gardens and landscaping meant to improve public movement space. This can include adding structures like park benches and art installations.

The grants also can be used for community clean-up projects related to overgrown weeds and graffiti removal.

Homeowners such as Cullin Flynn from the neighborhood of Minok Park led a community garden project on an abandoned lot funded through a $15,000 Beautification Grant. “Since then, we’ve put a storage container on the site, painted a beautiful mural on it, planted over a dozen fruit trees, raspberries, strawberries. It really opened my eyes that there's an investment,” Flynn said.

“I bought my home for $80,000.” Flynn added. “I wouldn’t be surprised to learn that my property value has doubled within three years.”

The City of Detroit funded the Neighborhood Beautification Program with $4.75 million from the Neighborhood Improvement Fund and ARPA. It is managed through a city partnership with the Wayne Metropolitan Community Action Agency.

Illegal Dumping

Illegal dumping has been rampant on Detroit’s vacant land. In addition to ordinary trash, illegal dumping can be large items—machinery, drywall, tires—and toxic materials—paint, pharmaceuticals—that require a permit or special disposal.

The Department of Neighborhoods and the General Service’s Blight Remediation Team combined their focus to clean up Detroit’s empty lots and alleys. Their mission was to decrease blight while giving Detroit neighbors agency within their own neighborhoods. They concentrated on alleys, illegally dumped debris and tree and bush trimming. The City of Detroit has removed 15 million square feet and 90,000 tons of brush, trash and debris from 3,026 alleys. That's the weight of nearly nine Eiffel Towers. The Alley Clean-Up program cleared 500 alleys in its launch year of 2020. It helps to reduce significant citywide blight. Neighborhood groups also make a commitment to maintain the alleys.

Detroiters Secure Housing Wealth through Home Repair Initiatives

By 2019, the City of Detroit was in active restoration mode. First-time homeowners filled vacant houses. Residents aggressively remediated blight. Detroiters exhaled inside safer, more connected neighborhoods.

But more than a third of homeowners need assistance to cover repair costs in their older homes. A University of Michigan study estimated Detroit’s home repair bill to be as high as $4 billion.

The Mayor, Detroit City Council and the City of Detroit created four repair-focused programs to support Detroiters.

The Detroit Home Repair Fund

The $45 million Detroit Home Repair fund first began offering 0% interest loans, from $5,000 to $25,000, in April 2022 in an effort to assist Detroit homeowners’ investment in and repair to their homes. Concentrating on health and safety hazards first, the funds can also be applied to electrical repairs, furnace replacement, roof replacement, plumbing, door and window replacements, porches and structural support. This program has served more than 160 Detroiters by adding value to their homes through stabilization and repair.

Renew Detroit Essential Home Repair Fund

The Renew Detroit Essential Home Repair Program, funded with $30 million from the American Rescue Plan Act and $15 million from the state of Michigan, dedicates itself to Detroit's low-income, senior and disabled homeowners.

Barbara I’Ron benefited from the Renew Detroit Home Repair Fund when her home received a new roof. “It's wonderful,” she said, “Thank God. It helped me a whole lot.” Barbara's roof was the 500th completed repair since the program's inception.

Eligibility for this income-based grant program requires three criteria: age (62 and older or 18 and disabled), being a Homeowner Property Tax Exemption (HOPE) participant, and not receiving a $10,000 city home repair grant within 10 years.

“The key is to get the folks in the neighborhoods to stop moving out. That's been the problem," Mayor Duggan said. “As we’ve got people moving into vacant houses and fixing them up, what about the person across the street whose house is starting to get run down?”

Duplex Repair Program

Funded with $2.3 million of Detroit's ARPA dollars, the grant-based Detroit Duplex Repair Program allows qualified landlords to apply for grants up to $15,000 per unit to obtain a rental Certificate of Compliance.

All units under this fund must be affordable to renters who earn up to 60% of area median income. This speaks directly to the City's Affordable Housing vision.

Delray Home Improvement Program

The same year Mayor Duggan took office, the United States Coast Guard issued a permit for the Gordie Howe International Bridge to run across the Detroit River between Detroit, Michigan and Windsor, Canada. This once-in-a-lifetime endeavor created an added benefit for the over 100 Detroit homeowners who lived within the shadow of the new bridge.

The Delray Home Improvement Program (DHIP) originated from feedback and requests from the Southwest Detroit community. The Local Initiatives Support Corporation (LISC) funded the new $4 million DHIP investment. By working in tandem with residents, business leaders and the City of Detroit, LISC created an expansive home repair program for those affected by the bridge construction.

This free-to-applicants program allows up to $20,000 per house in upgrades such as window and/or door replacement, roof repair and/or replacement, installing roof and/or wall insulation, and heating, ventilation, and/or air-conditioning (HVAC) repair or replacement.

Detroit Approaches the Finish Line

by Doubling Home Property Wealth

Detroit's meteoric rise in home appreciation occurred because Mayor Mike Duggan, City Council and dedicated Detroiters combined their vision with pragmatic planning. Detroit went from bankruptcy receivership to an investment-grade credit rating in 10 years with a double-notch credit upgrade. It was Detroit's third upgrade in as many years.

In 2014, Detroit's owner-occupied homes only held a collective property value of $4.2 billion. By 2022, that number nearly doubled to $8.1 billion. This increase is nationally unprecedented. In June 2024, Detroit was named the fastest home-value appreciating city in the United States.

Detroit's Hispanic neighborhoods saw the most rapid increase under Mayor Duggan's leadership. Detroit's Hispanic Southwest community increased their home wealth by 181%. That's a $298.1 million increase.

In a 10-year span, 2014 to 2024, Detroit saw its median home values grow most dramatically—increasing 299%—in neighborhoods with the lowest property values and the highest levels of poverty.

Mayor Duggan understood that there are many paths to build generational wealth, but he placed the city's focus on increasing home values, knowing its power in transforming neighborhoods. The city's programs and initiatives all sparked from his commitment to Detroit neighbors.

That's how a city nearly doubles its property value to $8.1 billion.